Dollar Steady Ahead of ISM Data

DXY Stable For Now

The US Dollar is softening again today but is up off the week’s lows following an uptick yesterday as traders reacted to better US data. The challenger job cuts data showed employers cut fewer jobs last month. This helped take some of the sting out of Wednesday’s dismal ADP employment print. With today’s headline NFP data set delayed due to the shutdown, focus will be on the upcoming ISM services print instead. In particular, traders will be looking at the employment component of the data.

Fed Speakers Due

Along with the ISM data we’ll also hear from some Fed speakers over the day, including the very dovish Miran. His comments could put some fresh pressure on USD particularly if he’s heard voicing concern over the impact of the shutdown and the urgent need for the Fed to cut further. Traders are currently pricing in a further .25% cut this month and a follow-up cut in December with another .5% of easing over H1 2026. However, if the shutdown drags on and the Fed starts to take a more concerned tone, this could see December easing expectations rising with traders looking for a larger cut ahead of year end. In this scenario, USD is vulnerable to a fresh move lower near-term.

Technical Views

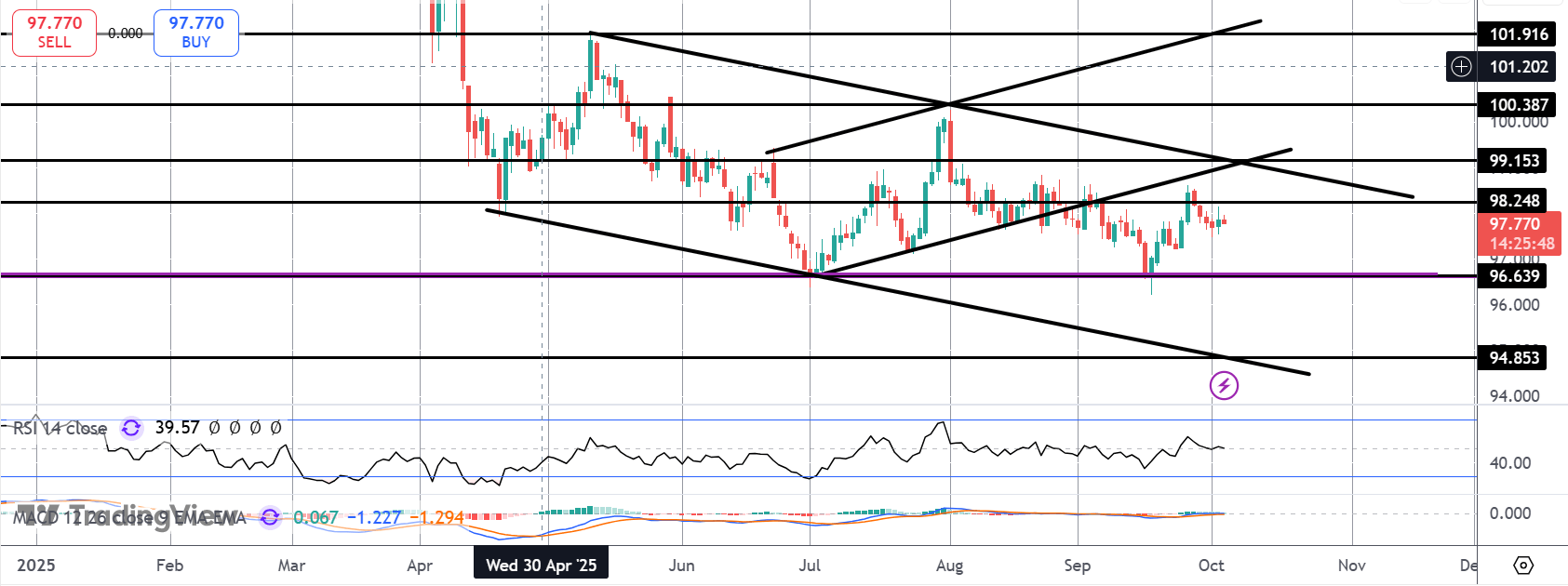

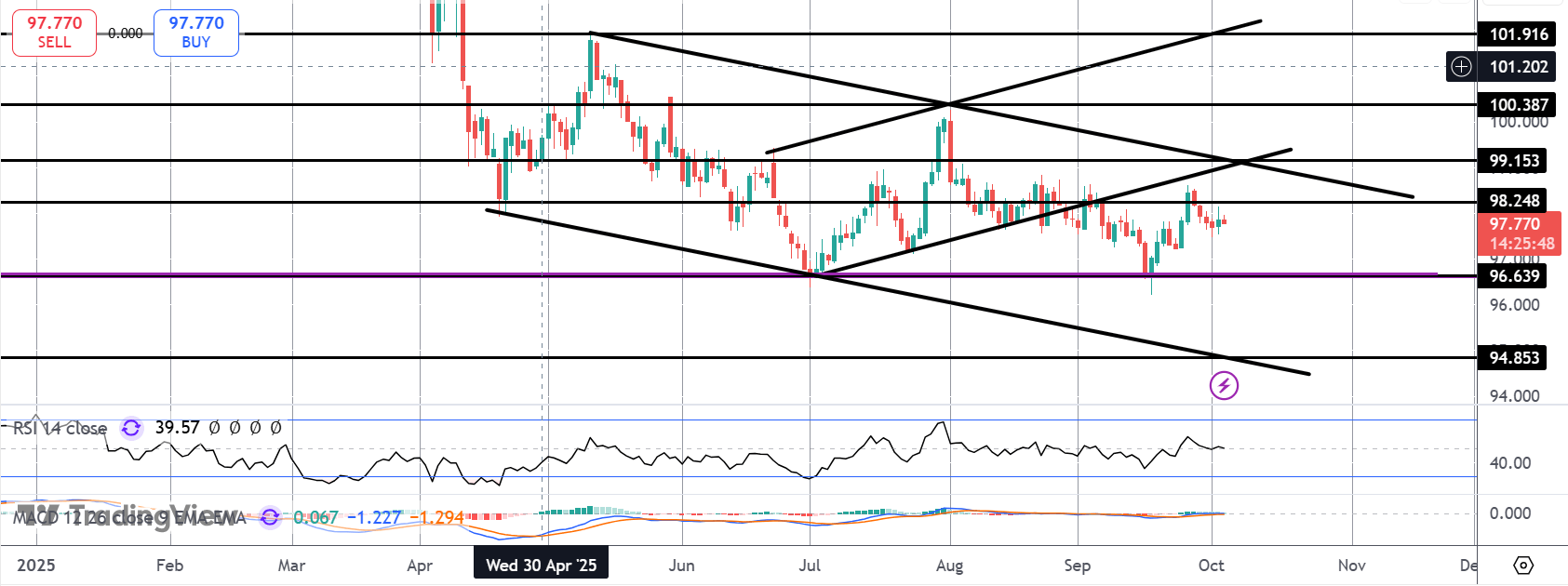

DXY

For now, DXY remains capped by the 98.24 level resistance, still below the broken bull channel and still within the bear channel. As such. A fresh test of 96.63 is on the cards with 94.85 the deeper level for bears to target if we push down. Topside, 99.15 and various trendline resistance will be the key pivot area for bulls to breach.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.