Institutional Insights: Goldman Sachs 'Crypto Pullback Continues'

Bitcoin briefly traded below $100,000 this week, a level not seen since June. Ethereum has wiped out all year-to-date gains. This analysis is exclusively for Goldman Sachs clients.

The typically positive October seasonality failed to materialise this year, with BTC, ETH, and SOL ending the month down -3.9%, -7.0%, and -10.2%, respectively. The selloff extended into early November, with BTC dropping from $110,000 on Monday to below $99,000 by Wednesday morning in Asia. Similarly, Ethereum declined sharply, falling from $3,900 to $3,100 (-20%), effectively erasing all gains accumulated this year (Figure 1).

These moves have been significant: Bitcoin and Ethereum have experienced drawdowns of approximately 21% and 38% from their all-time highs set earlier this year (Figure 1). Both assets have since stabilised, with Bitcoin hovering around $103,000 and Ethereum around $3,400.

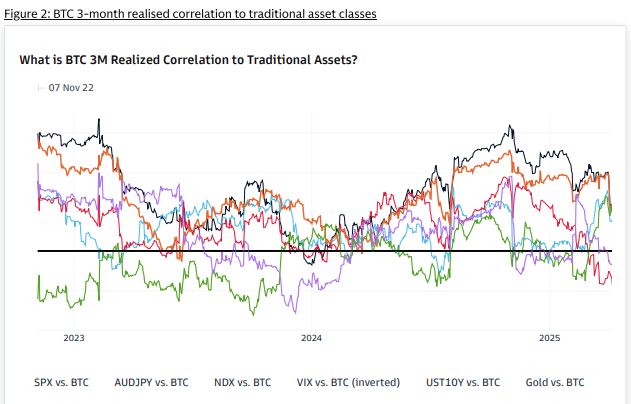

The cryptocurrency market has recently diverged from its longstanding positive correlation with US equity markets, a shift observed following the US-China trade escalations on October 10. While the SPX and NDX indices rebounded strongly to reach new all-time highs by the end of October (Bloomberg), Bitcoin and the broader cryptocurrency market have struggled to recover after significant deleveraging and a correction phase. Over the past week, Bitcoin's longer-term correlations with traditional asset classes have re-emerged (Figure 2). The recent weakness in the cryptocurrency market has mirrored broader equity market trends, with both the NDX and SPX retreating approximately 2% from their record highs amid rising concerns over private corporate credit.

Implied volatility for both Bitcoin and Ethereum has risen significantly since mid-October, reaching approximately 47 and 70 levels respectively, and has remained steady at these elevated levels. Realised volatility also remains high, as both assets continue to experience substantial intra-day trading ranges. Additionally, the cost of downside protection remains elevated, with 3-month 25-delta risk reversals for puts becoming more negative in both Bitcoin and Ethereum. Notably, Bitcoin's risk reversals for puts have reached their highest levels year-to-date.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!